ManageByStats

By Carbon6

Create your

FREE account!

Our most popular plan is now free! Get started today.

Ready to increase your profits? Easily manage and scale your Amazon business with ManageByStats’ integrated, data-powered software suite.

Get My Free Account

Trusted by the world’s top Amazon business advisors

Access All of Your Listing Data in One Place

Multiple tools working together, in one place.

ManageByStats provides high-value resources, data, and tools to optimize your Amazon business, all from one convenient platform.

Your Free Plan Includes:

Unlimited Review Automation

100 Keywords Tracked

KPI Dashboards

Inventory Management

Product Research Extension

Finances Breakdown Tool

Product Metrics & LTV

Automated Reports

Customizable Autoresponder

KPI Smart Notifications

Product Research Extension

4 Seller Accounts Free

Manage & Optimize Your Business

Profit Dashboard, Statistics, Graphs, Customers, Transactions, Feedback, Reviews, Inventory, and more.

We are constantly evolving our tools and features to meet the demands of Amazon marketplace.

Our goal is to help sellers make more profit on Amazon by better knowing their numbers and the actions to take to make an impact.

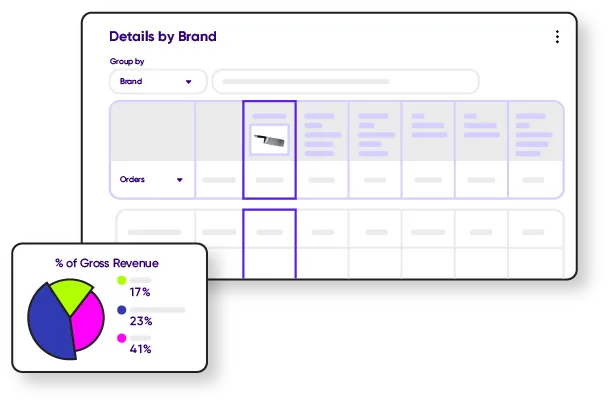

Get StartedFeedback & Review Request Automation

Automate Amazon Review Requests and filter customers based on feedback (linked directly in Seller Central).

SellerMail Automated Messaging

Automatically create and deploy custom buyer/seller messaging with custom customer outreach emails.

Profit

Dashboard

All of your key data points in one place. Explore profits, conversion rate, daily traffic, and more.

Businesses Trust ManageByStats

3,000+

Active Users

$393M

In Customer Revenue

467M

Transactions Monitored

1.1M

Products Monitored

Automate Checklists and Notifications

ManageByStats auto-generates custom checklists and sends relevant notifications to make sure you are staying on top of KPIs, reviews, inventory, listing changes, and more.

Get Started

Access all of your essential Amazon business data from one easy platform.

Get StartedGreat news:

Our starter plan is totally free!

Pay as you grow with no strings attached. No contracts, cancel any time.

MBS

Carbon6 Free Plan

Free

-

Seller Accounts – 4

-

Review Automation – Unlimited

-

Decisions Dashboard

-

Profit & KPI Dashboard

-

KPI Checklists & Smart Notifications

-

Financial Breakdowns

-

Statistic Trend Graphs

-

Automated Reports – Unlimited

-

Product Research Chrome Extension

-

Product Grouping & Tagging

-

Keyword Tracking – 100 Keywords Free

-

Customized Autoresponder – 1,000/mo Free

-

Inventory Management

-

Customer & Transactions Details

-

Product Metrics

-

Product Lifetime Value

-

User Management – Unlimited

-

Additional Users – Unlimited

-

Connect Multiple Seller Accounts & Countries

-

Initial sync: 12 months

MBS Pro

Plans start from

$59.97 USD /month

-

All Free Tools, plus:

-

Seller Accounts 8

-

Keyword Tracking – 250 Keywords Free

-

Additional Expenses Tracking

-

Competitor Analysis Tools

-

Listing Optimization Tools

-

Product Launch Tracker

-

Promo Codes Analytics

-

Geo Analytics Tracking

-

Repeat Purchase Rate metrics

-

Custom Audience Generator

-

University Training Videos

-

Affiliate System

MBS Enterprise

Advanced Features

Customized

-

All Pro Tools, plus:

-

Seller Accounts – 12

-

Advertising / PPC Manager

-

Custom Logo

-

Client Reporting

-

Dedicated Server

-

Dedicated Account Rep

-

Initial sync: 24 months

-

And more!

Frequently Asked Questions

Have more questions? Check out our FAQs.

Why do you need Developer Access to my Amazon Account?

Your Amazon data is not shared by Amazon unless you decide to share it. Any Amazon seller can give

access for third party developers (like us) to access reports and information from their seller account

through Amazon’s API – their system for automated access. Such automated access can make it possible to

get far more detailed information than what Amazon provides through your Seller Central account.

For us to get this information to you, you need to give us developer access as part of the sign-up

process.

Why do you need User Permissions for my Amazon Seller Account?

The Developer access you gave us provides access to most of the information we make available to you through ManageByStats. There are some reports that we cannot get this way on a daily basis – Amazon’s API doesn’t have an option for generating these daily through the API. We therefore ask for limited user permissions, so we can trigger these reports to be generated daily. Additionally, for Tech Support we sometimes need to look at these reports directly in Seller Central to make sure the data we are getting over the API matches what is being shown in Seller Central, so this gives us another layer of Quality Control to provide you with the most accurate reporting possible. This User Access is read only, so we are not able to make any changes in your Seller Central account.

How secure is my data?

We access your Seller Account through secure Amazon API connections. Your information is stored in a

separate database for just your data, on secure servers, which have security measures implemented to

conform with Amazon’s Security protocols, which are audited yearly by Amazon’s law firms, to make sure

we have all security measures in place to protect your information. This includes ensuring that not even

Amazon can access or see any of the information we have in our accounts for you.

Your information is used solely for displaying it back to you in ManageByStats, and is not viewed or

shared with anyone else.

Do you make any changes to my Amazon Seller Account?

We make no changes to your Amazon Seller account. The only things we do with your account are 1)

generating reports and 2) importing them into the dedicated database we created specifically for your

account, parsing the information to show it to you for easy duplication and management.

You are provided with some tools in MBS that enable you to make some changes in Seller Central. These

include:

- Advertising Manager – you can update bids and budgets for campaigns and keywords from our side, and these will update your Campaign Manager.

- Wordsmith – you can update your listing and then export these updates to Seller Central. We make this a 3-part process, so there is no way you can accidentally update your listing.

- Maximum Order Quantity: you can set this in MBS and it will update your max order quantity for each listing you set this for.

How exactly are the Statistics on ManageByStats counted?

The Quantity Ordered stat shows how many units have been ordered – even if they are pending orders, and even if they have not been paid for. As best we can tell, Amazon doesn’t collect the payment until they ship the item, and this can sometimes take a day or two – or more.

The Quantity Paid For stat shows how many units have been paid for – even if they were ordered earlier, and were just shipped and paid for now. Amazon provides financial information on each order after it has been shipped and paid for, so this provides actual useable detailed financial information and does not count pending orders (which may or may not end up being shipped and paid for).

The Product Sales Revenue stat shows the revenue generated by the units shipped and paid for – the ones counted in Quantity Paid For. Amazon counts the full revenue (before any discounts), so this is what this stat shows. If you sell 3 units that cost $100 each, this stat will show $300 even if you give a 50% discount and only $150 is collected from the customer.

The Net Revenue stat shows the corrected revenue after removing discounts. If you have many discount sales, the Net Revenue stat is a much better and more accurate stat for seeing real revenue.

The Amazon Payout stat shows the exact amount Amazon will pay out to you for these sales. So this is what is left for you after discounts and various Amazon fees have been taken out.

The Cost of Goods Sold stat shows your cost of good for the products sold, using the cost information you assigned to this product in the Settings / Products page. We count the cost on units sold. We do not subtract the cost of units refunded – as often refunded units cannot be resold.

The Quantity of Refunds stat simply shows the number of units refunded. The Buy Box stat shows the percentage of shopper sessions where your listing had the Buy Box. Amazon refers to this as the Buy Box Percentage.

The Conversion Rate stat shows what Amazon refers to as the Unit Session Percentage. It is essentially how many units were sold, divided by the number of shopper sessions viewing your product listing. If your conversion rate is 20%, then you sold 20 units for every 100 shoppers viewing your listing.

The Sales Rank stat shows your products’ Amazon Best Sellers Rank average for the time period shown. Sales Rank can vary by the hour at times, so this is the average Sales Rank for the time period you are viewing, for the product, product line or brand you are viewing.

The Sessions stat shows number of visits to your Amazon.com pages by a user. All activity within a 24-hour period is considered a session.

The Number Of Customer Reviews stat shows the total number of customer reviews.

The Average Customer Review stat shows the average customer review score for a product.

If I sell outside of the USA, can I still use ManageByStats?

Yes, we support most Amazon Marketplaces, and you can log into your account from anywhere in the world.